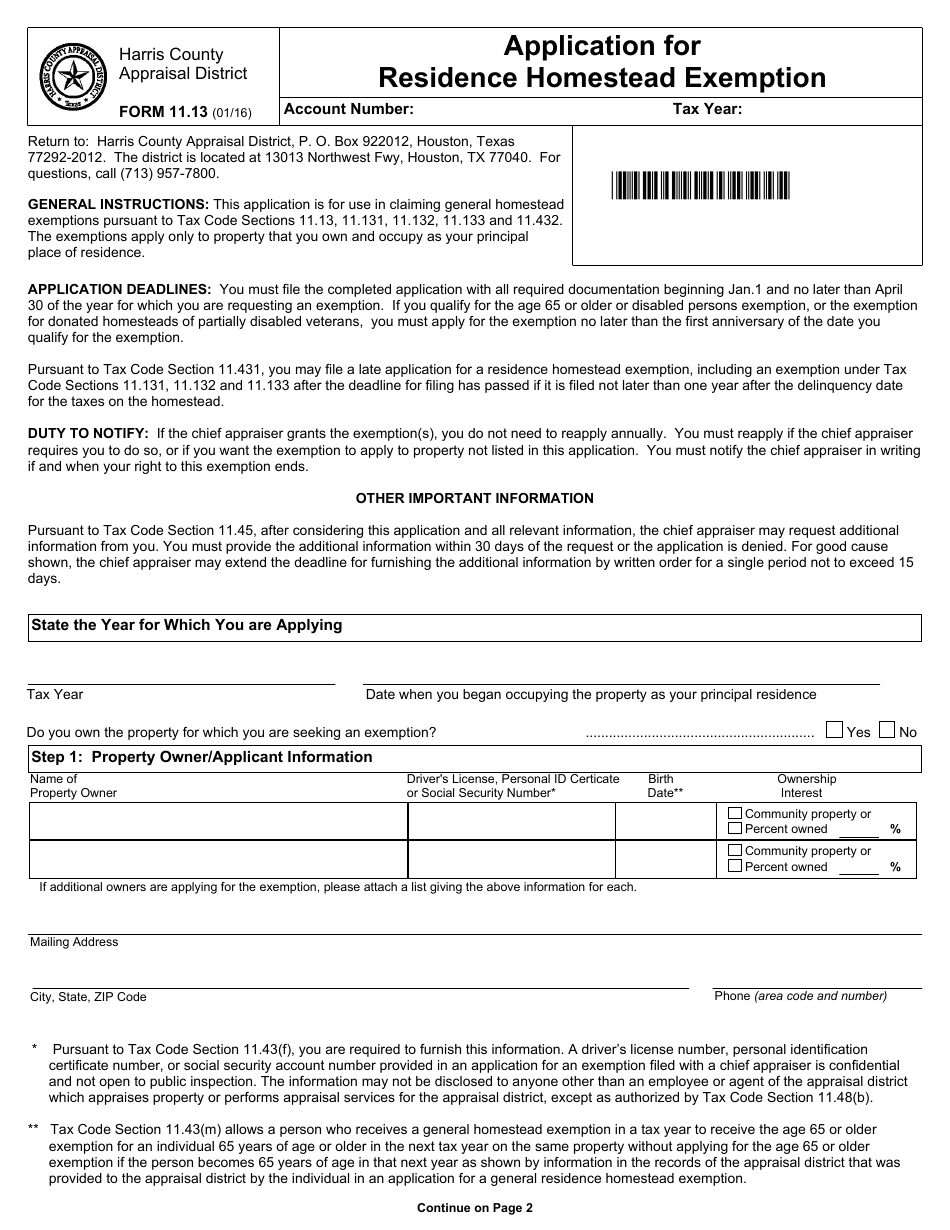

There is a rollback tax for taking agricultural land out of its productivity use. Landowners must use their land for agriculture. Typically, a productivity value is lower than the market value, which results in a lower property tax. Landowners may apply for this special appraisal status based on their land's productivity value rather than on what the land would sell for on the open market. Therefore, it is actually an agricultural appraisal. It is a county appraisal district assessment valuation based on agricultural use.

The Texas agricultural exemption is not technically an exemption.

0 kommentar(er)

0 kommentar(er)